The United States has a financial literacy problem (that’s why Money Vehicle exists!). Financial literacy rates, and U.S. financial literacy overall, leave a lot to be desired. But through financial education and empowering students with knowledge about money, there’s hope for a turnaround.

Depending on your source, too, it can take time to get a real sense of how U.S. financial literacy rates stack up, especially compared to other countries worldwide. We’ll choose one, though, to get a sense of how the U.S. ranks: The Standard & Poor’s Ratings Services Global Financial Literacy Survey, the largest such measurement of financial literacy in the world, which is based on interviews with 150,000 people in 140 countries.

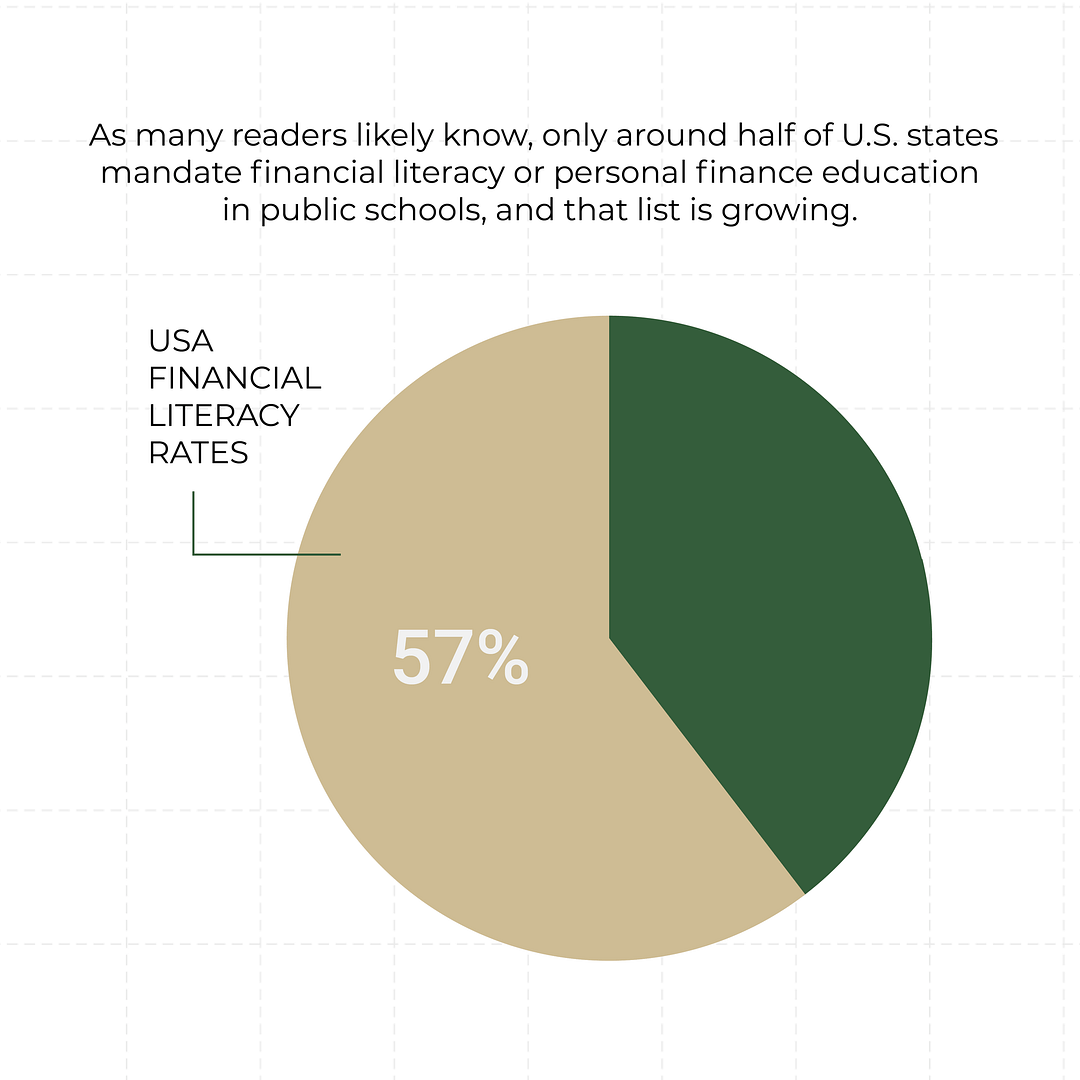

That survey finds that only 33% of adults around the world are financially literate, and that 57% of adults in the U.S. are financially literate. While the U.S. does outdo the worldwide average, it lags behind several other OECD countries, too.

Financial Literacy in the U.S.

As mentioned, the survey finds that 57% of U.S. adults are financially literate, and naturally, the actual rates vary from state to state. But by and large, 57% isn’t a great score — if you got 57% on a test, you likely wouldn’t be feeling great about it, as it would amount to an “F.”

This is, naturally, a probable result of a lack of financial literacy education in many U.S. schools. As many readers likely know, only around half of U.S. states mandate financial literacy or personal finance education in public schools, and that list is growing. And while the U.S. financial literacy rates may look good by worldwide standards, the U.S. isn’t in the top ten and ranks behind many other developed countries.

Financial Literacy Rates Worldwide

The countries that led the world per the S&P financial literacy survey were as follows:

While the U.S. got a score of 57%, the scores of the countries above ranged from 63% (Finland) to 71% (a tie between Norway and Sweden). As for the countries that scored the lowest? Afghanistan, Albania, Somalia, Tajikistan and Yemen are among them, with scores mostly ranging in the teens.

There are a multitude of reasons as to why adults in some countries are more financially literate than others, and a lot of it starts with education.

Check out the Money Vehicle textbook — you can find it here on Amazon. And if youlike what you see, you can get more content sent directly to your inbox! Sign up for the Money Vehicle Movement Newsletter!

And check out our white paper: “Strategies for Increasing Financial Literacy Rates Among High School and College Students”

More from Money Vehicle: